maryland tax lien payment plan

Tax liens offer many opportunities for you to earn above average returns on your investment dollars. Maryland Tax Lien Payment Plan.

Tax Liabilities In Maryland Resolved 20 20 Tax Resolution

So I never received.

. The registration fee is not applied toward the purchase of tax sale certificates. If you already have a tax lien taxpayers can set up a 60-month payment plan with. Tax sale dates are determined and vary by individual counties.

Act Quickly to Resolve Your Tax Problems. Maryland tax lien payment plan. 10480 Little Patuxent Pkwy 400.

Also the tax lien is a public. Tax liens accrue interest rates as high as 20 in some counties. If you file electronically and pay by check or money.

I lived there for about two years and then left since 2005. Make a credit card payment. You can send money in with your tax return.

Anyone attempting to pay off a lien holder must pay them the interest as well. There is a 249 service charge because this is processed via. The only surefire way to get rid of your Maryland tax lien is to pay your tax debt in full.

A tax lien may damage your credit score and can only be released when the back tax is paid in full. Sales are published in the local newspaper and. Maryland utilizes a tax lien certificate system to collect delinquent property taxes.

This system may be used to make bill payments on business taxes using electronic funds withdrawal direct debit from a us. April 18 th 25 th. Select the appropriate radio button to search cases by Person or Company.

Ad IRS Interest Rates Have Increased. Hello I had a Maryland Tax Lien showing on my CR since September 2011 for unpaid for 2005. Or you can send.

HelloI had a Maryland Tax Lien showing on my CR since September 2011 for unpaid for 2005. Online application to allow individuals and businesses to pay for the following taxes. Default is person Person.

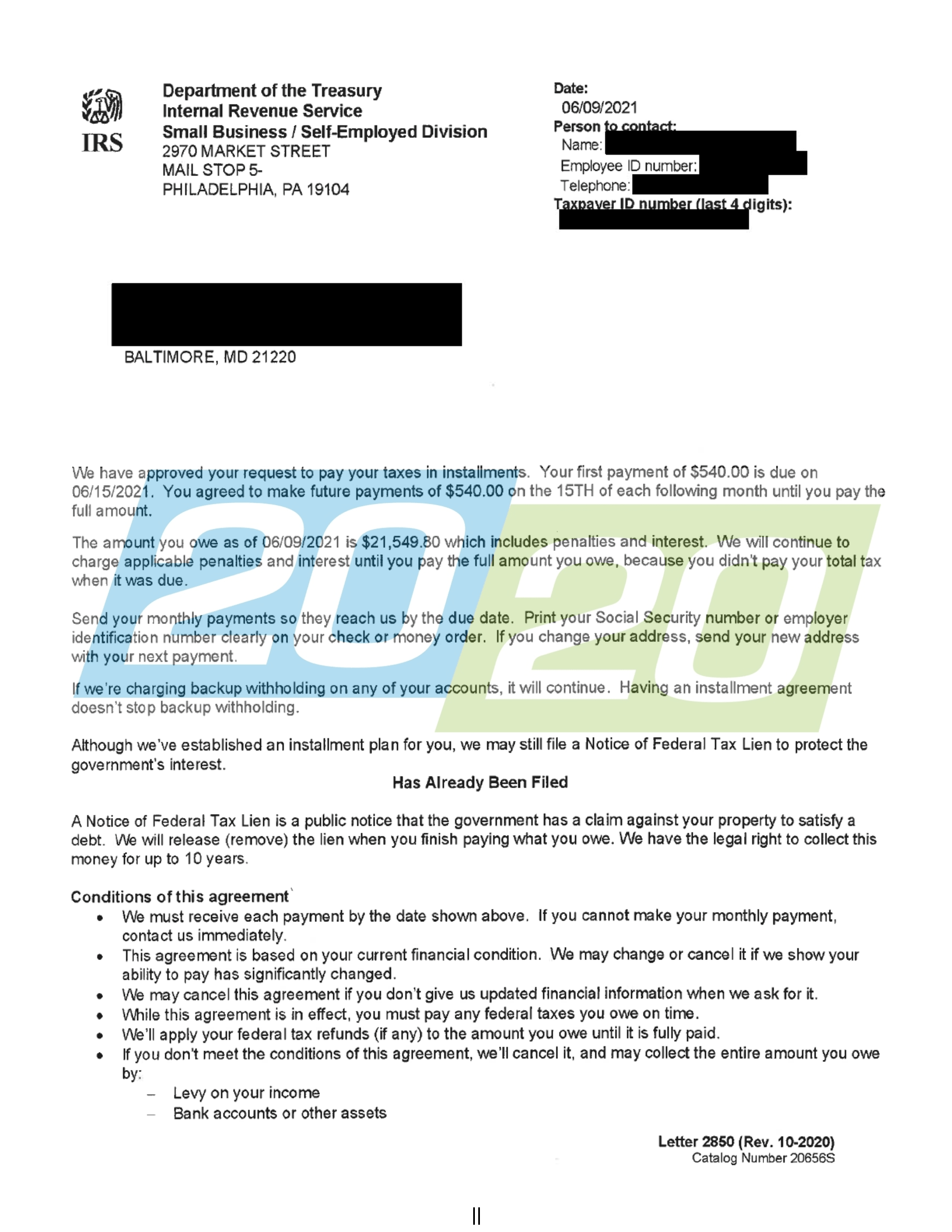

A Maryland tax payment plan may be available if you have a state tax liability that is beyond your means. A payment agreement is very much like an IRS Installment Agreement. I lived there for about two years and then left since 2005.

Check your Maryland tax liens. Act Quickly to Resolve Your Tax Problems. You can wait for a notice and pay with that voucher.

Maryland Judiciary Judgment and Liens Search. Optima Tax Relief is BBB Accredited with an A Rating - Free Consultation. Generally if you dont have a lien you can get a 36-month payment plan with no financial required MD 433-A.

Individual Income and Business Tax Payments. Ad IRS Interest Rates Have Increased. Make a personal estimated payment - Form PV.

I do plan to follow. Optima Tax Relief is BBB Accredited with an A Rating - Free Consultation. Tax Payment Agreement If you owe the State of Maryland taxes and cannot pay one option is set up a tax payment plan.

Alternative electronic check payment options are available through the office of the Comptroller of Maryland. A non-refundable 15000 registration fee is required and a 100000 deposit. This is a very high interest rate.

There are a few ways you can pay a Maryland tax debt. Just remember each state has its own bidding process. Taxpayers who owe past-due state taxes may be able to qualify for a.

This electronic government service includes a serviceconvenience. If a taxpayer cannot pay the tax owed in full the taxpayer has the option of setting up. Welcome to the Comptroller of Marylands Online Payment Agreement Request Service.

Taxpayers can apply for this program online or when responding to their. You may use this service to set up an online payment agreement for your Maryland personal income tax. However if you cant pay your taxes you may be able to negotiate to get your lien.

Make a personal extension payment - Form PV. You can pay your Individual Maryland taxes with a personal check or money order if you prefer not to pay electronically or with a credit card. Taxpayers wishing to pay off a tax debt through an installment agreement who owe more than 25000 are generally required to complete one.

The Comptrollers Office must protect the states interest when offering a lengthy payment plan by recording a tax lien in the appropriate circuit court My Individual Return Was Audited My.

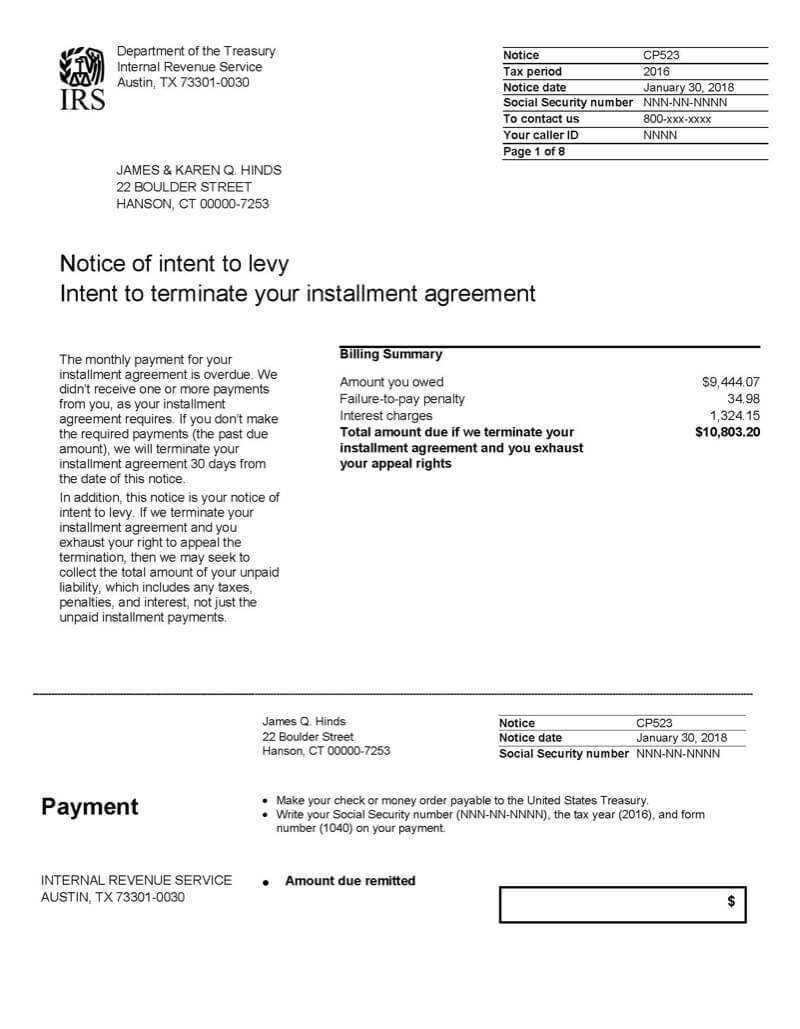

What Is A Cp523 Irs Notice Jackson Hewitt

Tax Liabilities In Maryland Resolved 20 20 Tax Resolution

Limited Time Offer Subject To Change Qualifying Credit New Home Internet Line Required Sales Tax Regulato Home Internet Internet Shop Internet Providers

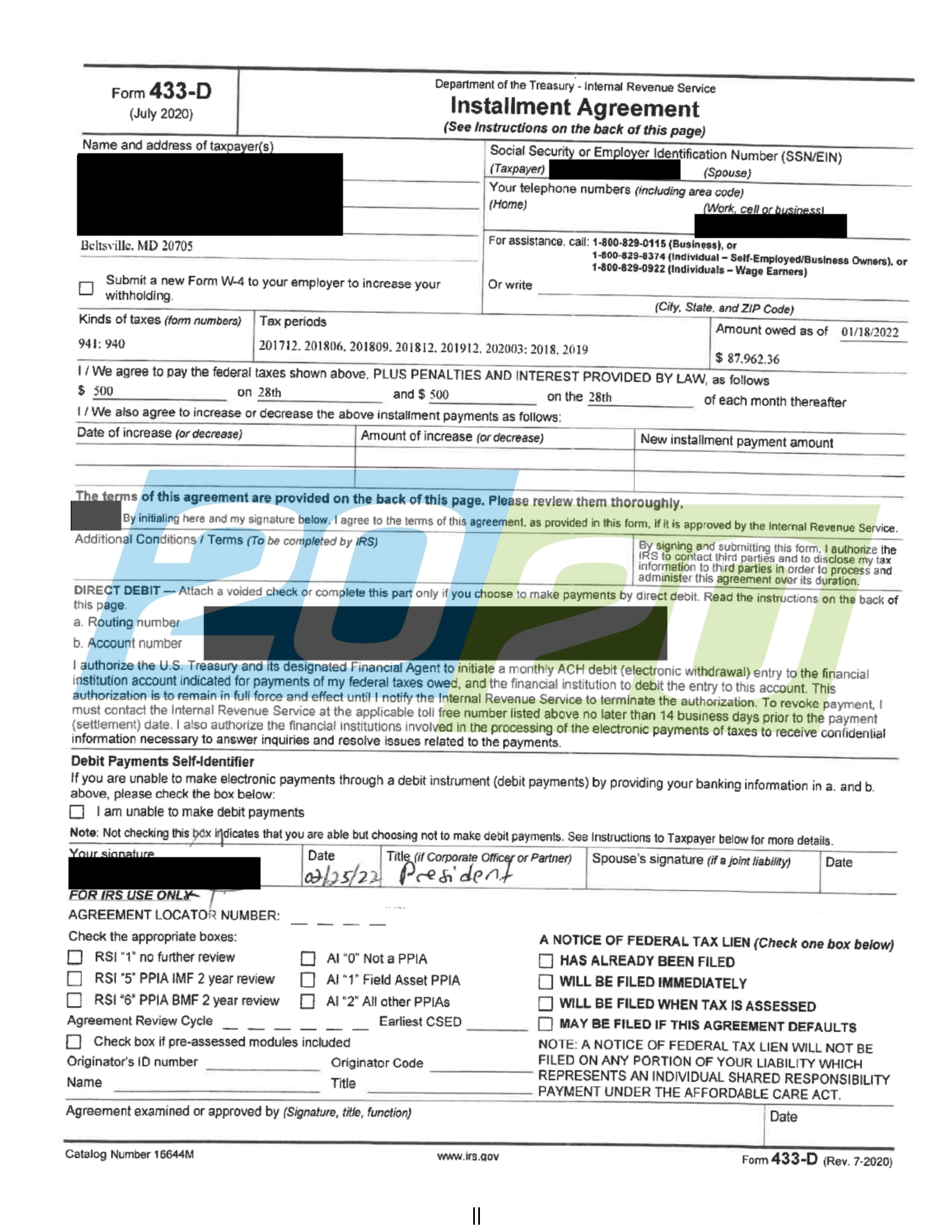

Irs Letter 2272c Installment Agreement Request H R Block

Tax Liabilities In Maryland Resolved 20 20 Tax Resolution

Maryland Tax Payment Plan Tax Group Center

Irs Letter 4458c Second Installment Agreement Skip H R Block

Irs Letter 2975 Intent To Terminate Installment Agreement H R Block

Get More Tax Clients With Tax Resolution Services Corvee

Tax Lawyer Tax Attorney Represent Individuals Or Business With Different Problems Such As Tax Collection Problems Sale Debt Relief Programs Irs Taxes Tax Debt

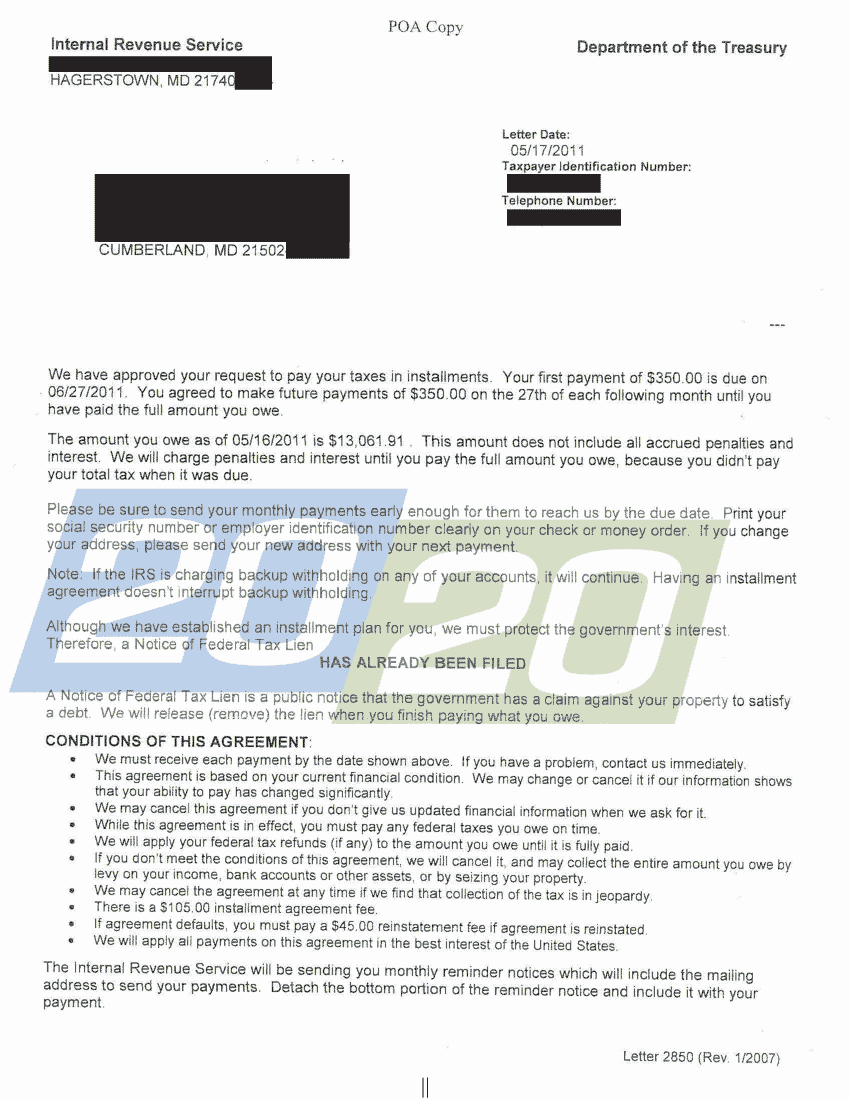

Irs Accepts Installment Agreement In Cumberland Md 20 20 Tax Resolution

Tax Liabilities In Maryland Resolved 20 20 Tax Resolution

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

What Is A Property Lien An Unpaid Debt That Could Trip Up Your Home Sale Estate Tax Home Buying Real Estate Investing

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

Arts Integration Archives Professional Development For Teachers Instructional Coaching Arts Integration

Common Irs Audit Triggers Bloomberg Tax

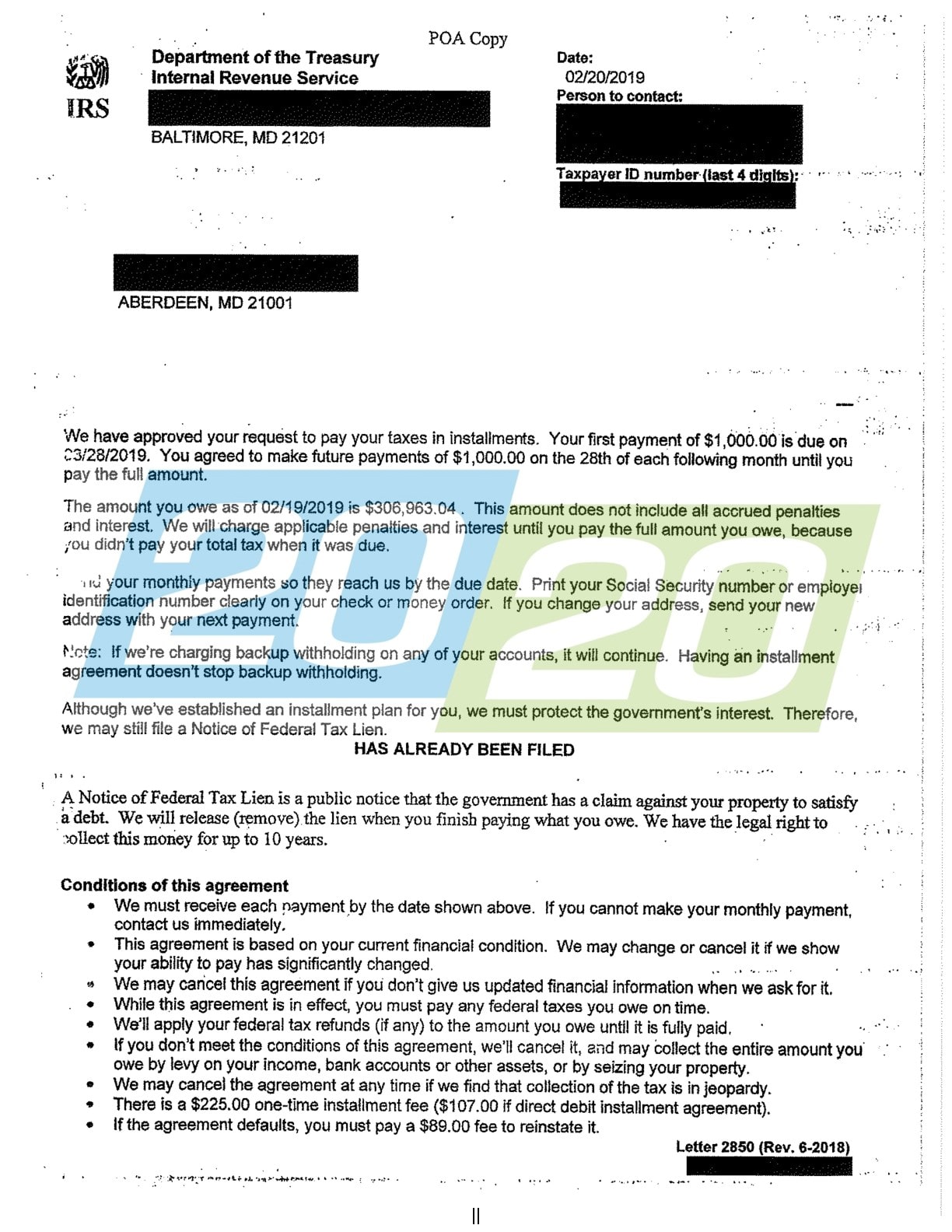

Irs Accepts Installment Agreement In Glen Burnie Md 20 20 Tax Resolution